West Virginia Business Occupation Tax . Who is required to file? We are here to provide you with efficient government services to assist. business & occupation tax frequently asked questions (faq’s) q. business & occupation tax frequently asked questions (faq’s) q. Who is required to file? business & occupation tax returns. All persons who are engaged in business within the city. The main revenue source for west virginia cities is the business and occupation tax. business and occupation, severance, excise and property tax. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. This section deals with taxes levied on business and occupation. charleston, west virginia government works for you.

from www.templateroller.com

The main revenue source for west virginia cities is the business and occupation tax. Who is required to file? striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. charleston, west virginia government works for you. business & occupation tax returns. All persons who are engaged in business within the city. We are here to provide you with efficient government services to assist. This section deals with taxes levied on business and occupation. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. Who is required to file?

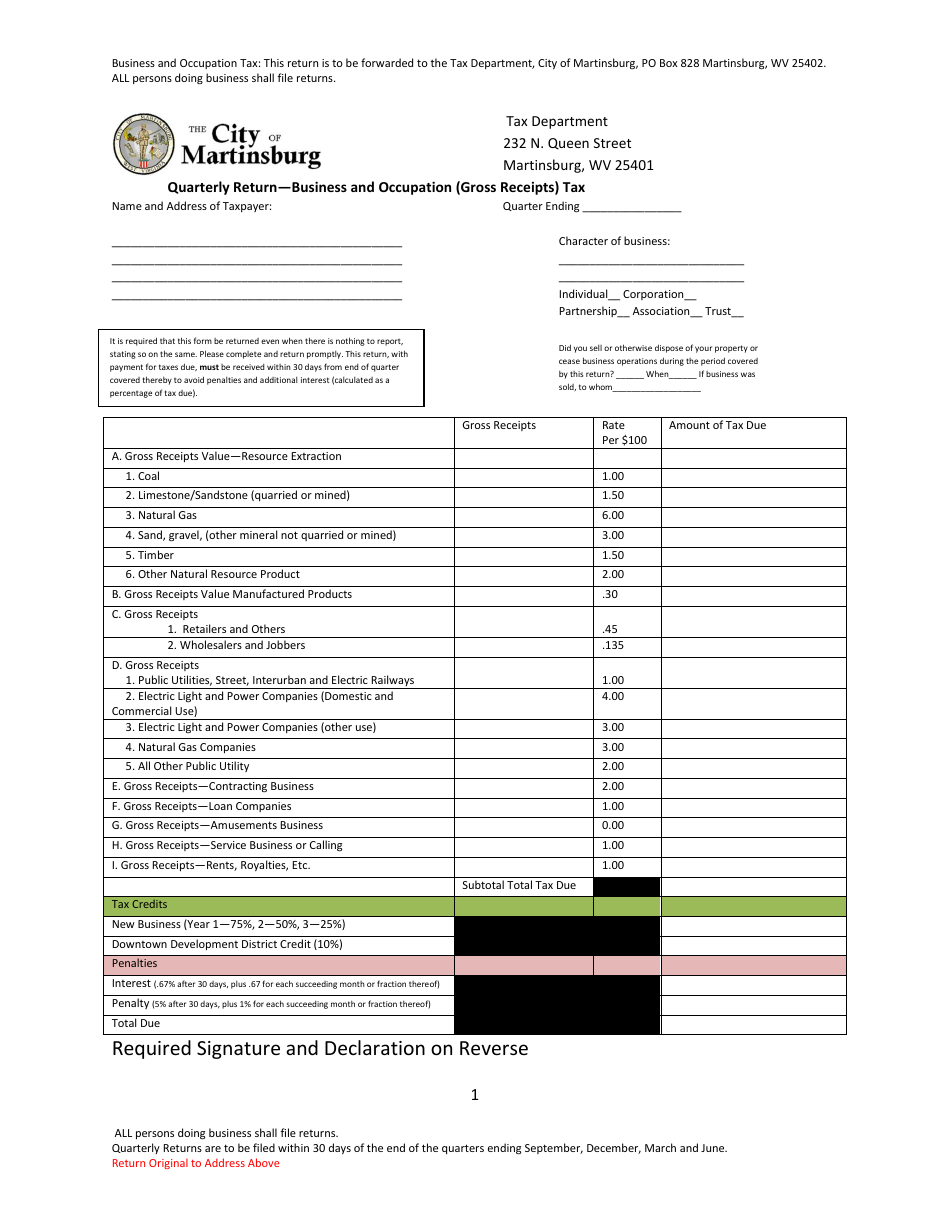

West Virginia Quarterly Return Business and Occupation (Gross

West Virginia Business Occupation Tax This section deals with taxes levied on business and occupation. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. All persons who are engaged in business within the city. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. Who is required to file? business and occupation, severance, excise and property tax. business & occupation tax frequently asked questions (faq’s) q. We are here to provide you with efficient government services to assist. charleston, west virginia government works for you. business & occupation tax returns. Who is required to file? business & occupation tax frequently asked questions (faq’s) q. The main revenue source for west virginia cities is the business and occupation tax. This section deals with taxes levied on business and occupation.

From www.formsbank.com

Business & Occupation Tax Quarterly Return City Of Saint Albans, West West Virginia Business Occupation Tax business & occupation tax frequently asked questions (faq’s) q. Who is required to file? We are here to provide you with efficient government services to assist. business & occupation tax frequently asked questions (faq’s) q. business & occupation tax returns. Who is required to file? business and occupation, severance, excise and property tax. This section deals. West Virginia Business Occupation Tax.

From www.formsbank.com

Form Wv/bot301e 2006 West Virginia Annual Business & Occupation Tax West Virginia Business Occupation Tax business & occupation tax frequently asked questions (faq’s) q. This section deals with taxes levied on business and occupation. business and occupation, severance, excise and property tax. business & occupation tax returns. Who is required to file? a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public. West Virginia Business Occupation Tax.

From www.templateroller.com

West Virginia Quarterly Return Business and Occupation (Gross West Virginia Business Occupation Tax a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. charleston, west virginia government works for you. Who is required to file? Who is required to file? business & occupation tax returns. All persons who are engaged in business within the city. business & occupation. West Virginia Business Occupation Tax.

From www.templateroller.com

Form WV/BOT301e Fill Out, Sign Online and Download Printable PDF West Virginia Business Occupation Tax Who is required to file? Who is required to file? business & occupation tax returns. business & occupation tax frequently asked questions (faq’s) q. We are here to provide you with efficient government services to assist. charleston, west virginia government works for you. business & occupation tax frequently asked questions (faq’s) q. a business and. West Virginia Business Occupation Tax.

From www.formsbank.com

Business & Occupation Tax Quarterly Return City Of Saint Albans, West West Virginia Business Occupation Tax a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. Who is required to file? business & occupation tax frequently asked questions (faq’s) q.. West Virginia Business Occupation Tax.

From www.formsbank.com

Form Wv/bot301 West Virginia Annual Business & Occupation Tax Return West Virginia Business Occupation Tax This section deals with taxes levied on business and occupation. charleston, west virginia government works for you. All persons who are engaged in business within the city. Who is required to file? business & occupation tax frequently asked questions (faq’s) q. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state. West Virginia Business Occupation Tax.

From www.templateroller.com

West Virginia Business and Occupation Tax Return Form Fill Out, Sign West Virginia Business Occupation Tax All persons who are engaged in business within the city. This section deals with taxes levied on business and occupation. We are here to provide you with efficient government services to assist. business & occupation tax frequently asked questions (faq’s) q. The main revenue source for west virginia cities is the business and occupation tax. Who is required to. West Virginia Business Occupation Tax.

From www.templateroller.com

Form WV/BOT300 Fill Out, Sign Online and Download Printable PDF West Virginia Business Occupation Tax business & occupation tax frequently asked questions (faq’s) q. business and occupation, severance, excise and property tax. business & occupation tax returns. This section deals with taxes levied on business and occupation. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. All persons. West Virginia Business Occupation Tax.

From www.formsbank.com

Quarterly Return Business & Occupation Privilege(Gross Sales) Tax West Virginia Business Occupation Tax All persons who are engaged in business within the city. business & occupation tax returns. This section deals with taxes levied on business and occupation. Who is required to file? business & occupation tax frequently asked questions (faq’s) q. The main revenue source for west virginia cities is the business and occupation tax. We are here to provide. West Virginia Business Occupation Tax.

From www.formsbank.com

Fillable Form Wv/bot300 West Virginia Business And Occupation Tax West Virginia Business Occupation Tax business & occupation tax returns. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. All persons who are engaged in business within the. West Virginia Business Occupation Tax.

From www.formsbank.com

Form Wv/bot301 West Virginia Annual Business & Occupation Tax Return West Virginia Business Occupation Tax business & occupation tax returns. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. charleston, west virginia government works for you. business and occupation, severance, excise and property tax. We are here to provide you with efficient government services to assist. striving to. West Virginia Business Occupation Tax.

From www.formsbank.com

Quarterly Return Business & Occupation Privilege(Gross Sales) Tax West Virginia Business Occupation Tax charleston, west virginia government works for you. business & occupation tax frequently asked questions (faq’s) q. business & occupation tax frequently asked questions (faq’s) q. This section deals with taxes levied on business and occupation. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or.. West Virginia Business Occupation Tax.

From www.templateroller.com

Form WV/BOT300g Download Printable PDF or Fill Online Business and West Virginia Business Occupation Tax We are here to provide you with efficient government services to assist. business & occupation tax returns. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. business & occupation tax frequently asked questions (faq’s) q. Who is required to file? business & occupation tax. West Virginia Business Occupation Tax.

From www.formsbank.com

Business & Occupation Privilege(Gross Sales) Tax City Of Weeling West Virginia Business Occupation Tax charleston, west virginia government works for you. We are here to provide you with efficient government services to assist. All persons who are engaged in business within the city. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. a business and occupation tax is. West Virginia Business Occupation Tax.

From www.formsbank.com

Wv/bot300e 1/07 Business & Occupation Tax Estimate Form West West Virginia Business Occupation Tax business & occupation tax returns. Who is required to file? charleston, west virginia government works for you. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. business & occupation tax frequently asked questions (faq’s) q. business & occupation tax frequently asked questions (faq’s). West Virginia Business Occupation Tax.

From www.templateroller.com

City of Huntington, West Virginia Business and Occupation Tax Return West Virginia Business Occupation Tax striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. business and occupation, severance, excise and property tax. We are here to provide you with efficient government services to assist. Who is required to file? charleston, west virginia government works for you. business &. West Virginia Business Occupation Tax.

From www.templateroller.com

City of Huntington, West Virginia Business and Occupation Tax Return West Virginia Business Occupation Tax The main revenue source for west virginia cities is the business and occupation tax. a business and occupation tax is imposed on any persons(s) engaging or continuing with the state in any public service or. We are here to provide you with efficient government services to assist. Who is required to file? business and occupation, severance, excise and. West Virginia Business Occupation Tax.

From www.formsbank.com

Form Wv/bot301e West Virginia Annual Business & Occupation Tax West Virginia Business Occupation Tax business & occupation tax frequently asked questions (faq’s) q. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. charleston, west virginia government works for you. business and occupation, severance, excise and property tax. We are here to provide you with efficient government services. West Virginia Business Occupation Tax.